SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Dice Financial Services Group

1716 N. Sanborn Blvd

Mitchell, SD 57301

Phone: 605-996-7171

Toll-Free: 800-658-3603

Website: www.dicefinancial.com

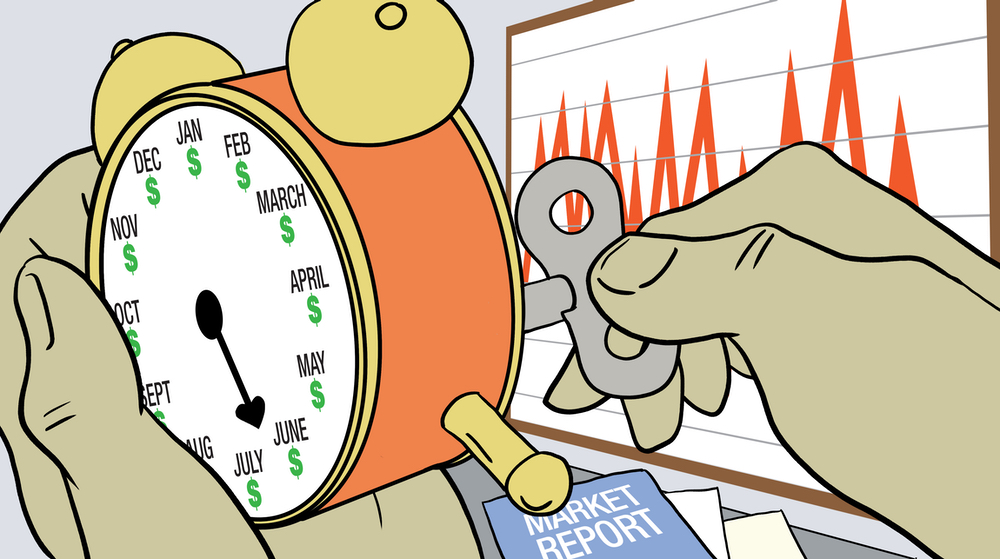

Big swings in investment values may make headlines, but trying to predict market volatility isn’t usually a recipe for success. In contrast, a slow and steady investing approach may be boring but it can help you use market fluctuations to your advantage as you invest for long-term financial goals. Dollar-cost averaging* can play a part in this approach.

Buying the same dollar amount of any investment doesn’t, however, mean you are buying the same amount of each investment’s shares each period. When stock prices rise, you get fewer shares for your $50. So if stock prices double to $2 per share, you would buy 25 shares. And if fixed income shares declined to 75 cents a share, your $50 would buy almost 67 shares. In other words, you buy more securities with declining prices and fewer whose price has increased.

Dollar-cost averaging takes the emotion out of investing, providing a way to maintain a consistent investing approach regardless of short-term volatility, with an eye on long-term goals.

*Investing regular amounts steadily over time (dollar-cost averaging) may lower your average per-share cost, but this investment method will not guarantee a profit or protect you from a loss in declining markets. Effectiveness requires continuous investment, regardless of fluctuating prices. You should consider your ability to continue buying through periods of low prices.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Securities and investment advisory services offered through Osaic Wealth, Inc. member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Insurance Services offered through Dice Financial Services Group.

Dice Financial Services Group and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.