SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Anthony Penree

Financial Advisor

LTM Marketing Solutions, LLC

1060 Broadway #1161

Albany, NY 12204

Phone: 518-870-1081

Email: apenree@ltmclientmarketing.com

Website: ltmclientmarketing.com

Millennials face challenging financial obstacles, including high student loan debt and a difficult entry into an expensive real estate market. However, they have one advantage that older generations never have: Time is on their side. If you're a Millennial, consider how you can find the money needed for long-term financial goals even with other financial obligations.

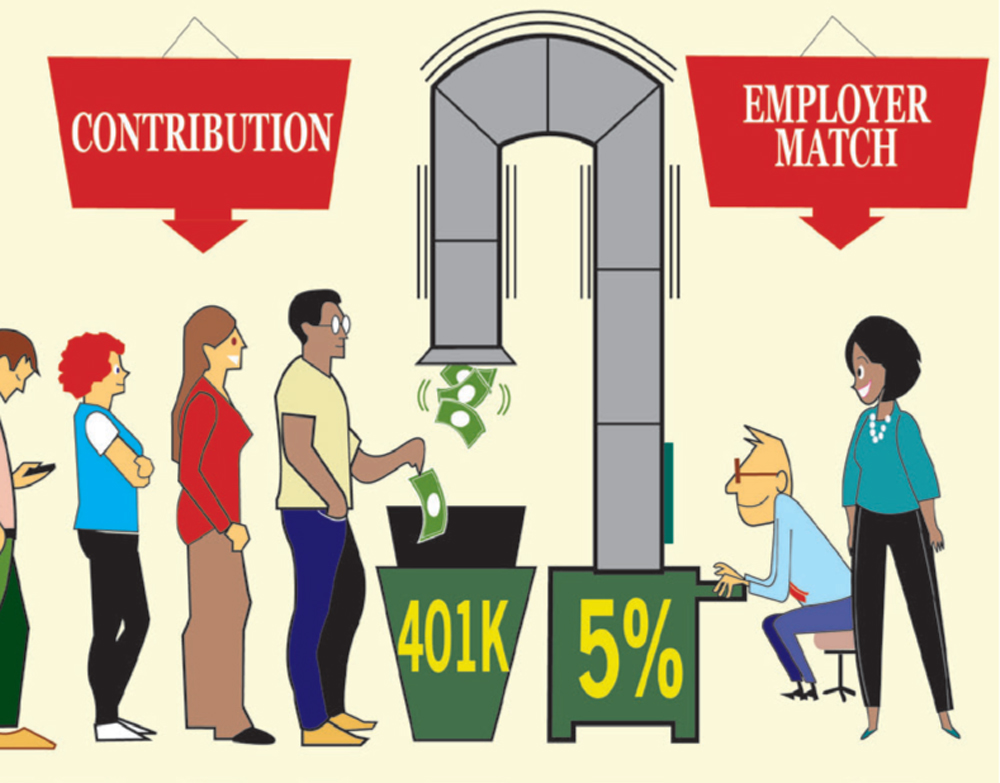

Next, make that extra 10% part of a disciplined investing strategy. As irritating as these loans may be, avoid paying your low-interest-rate student debt early and consider making better use of any extra money. Consider investing for long-term goals like retirement, which you can easily do by participating in your company 401(k) plan.

Here’s one hypothetical example of how your money can grow: Let’s say you earn $5,000 per month. You put 10% of your monthly income, or $500, into your 401(k). Your employer matches 3%, adding another $150 monthly. If this $650 per month earns 6% compounded daily over 40 years, the total contribution of your $240,000 and your employer’s $72,000 would grow to more than $1.3 million. **

Understand that time means everything in this example because investing the exact total over a smaller amount of time will not come close to matching the number previously cited. So, get started today and put something away for the future.

*https://www.federalreserve.gov

**This is a hypothetical example and is not representative of any investment strategies. Actual results may vary.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

ABC Company and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative. * Securities offered through ABC Company, Member SIPC, 1060 Broadway #1161, Albany, NY 12204.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.