SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Social Security provides supplemental income for your retirement income, so how much or little you get from this important program can matter. You control how much you’ll receive, within certain limits. When you begin receiving benefits and whether you continue to work are two major factors that will affect what you receive.

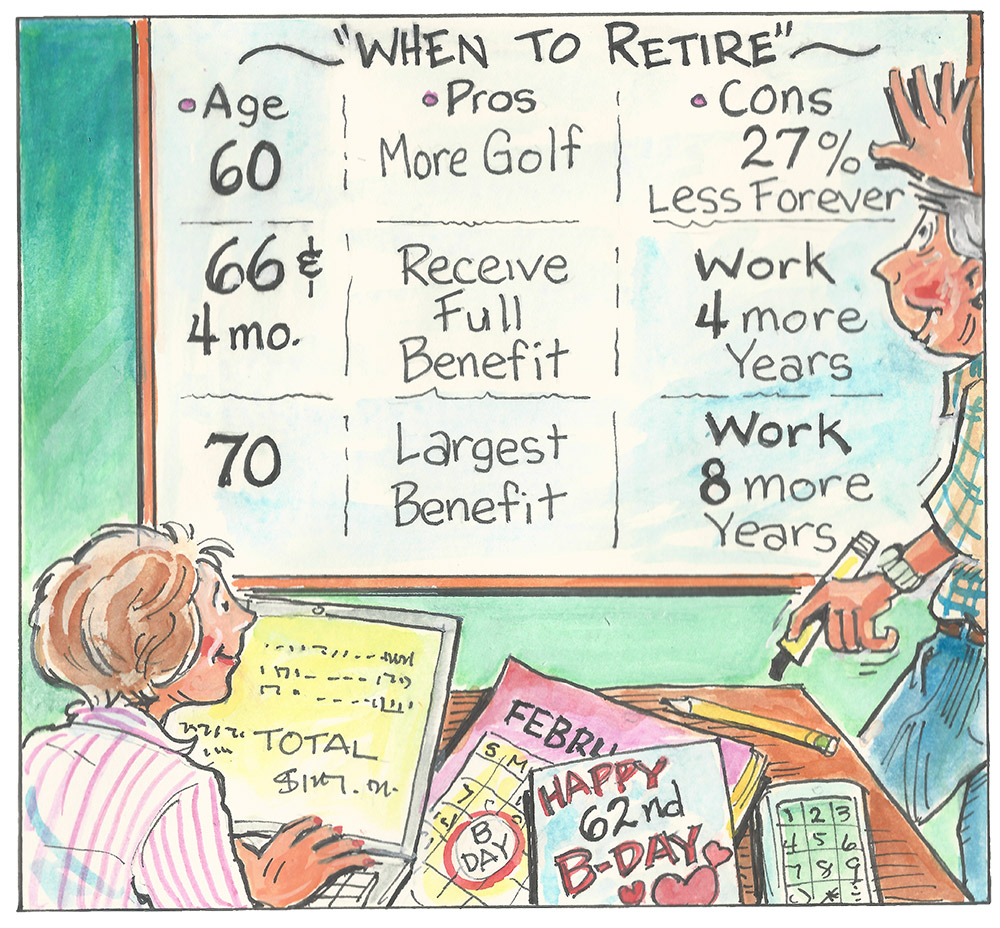

If you choose to begin Social Security benefits before your full retirement age, you will permanently receive less than if you waited to take benefits. If you were born, for example, in 1956, your full retirement age is 66 years and four months. You can begin taking the benefit as early as age 62, but it will be reduced by nearly 27% per month — forever. And if you receive benefits and are under full retirement age for the entire year, Social Security will deduct $1 from your benefit payments for every $2 you earn above the annual earnings limit. That limit was $16,920 in 2017 and $17,040 in 2018.

In the year you reach full retirement age, Social Security will deduct $1 in benefits for every $3 you earn above a different limit. One bonus is a special rule that lets Social Security pay a full check for any whole month the agency considers you retired, regardless of your yearly earnings. Once reaching full retirement age, your earnings won’t reduce your benefits any longer, no matter what you earn.

If you have a spouse, you can receive Social Security based on that person’s earnings, whether you ever worked a day or not. The spousal benefit can be as much as half of the worker’s benefit if the worker is at least full retirement age.

If the spouse begins receiving benefits before full retirement age, the spousal benefit will be reduced, unless the spouse cares for a qualifying child. A qualified child is under age 16 or is any age while receiving Social Security disability benefits.

When a spouse dies, the surviving spouse may receive that person’s benefits once reaching:

Additionally, dependent parents can get benefits if they’re age 62 or older and received at least half of their support from the deceased.

Depending on your age and relationship to the deceased person, your benefits can be generous. At full retirement age or older, a spouse generally receives 100 percent of the deceased spouse’s benefit amount. At any age, a surviving spouse with a child younger than age 16 gets 75 percent of the worker’s benefit amount, and the child gets the same amount.

Total benefits received by survivors are generally capped at 150% to 180%. Generally, a surviving widow or widower will not receive a reduction in the deceased spouse’s benefit.

While Social Security provides a foundation, it may best serve you if it is only one part of a comprehensive retirement savings strategy. Talk to a financial professional to learn more.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Active Planning & Investment Solutions and LTM Client Marketing are unrelated companies. This newsletter was created by LTM Client Marketing and was not written or created by the named financial professional and does not necessarily represent the views and opinions of Avantax Wealth Management® or its subsidiaries.

Avantax affiliated advisors may only conduct business with residents of the states for which they are properly licensed and registered. Securities offered through Avantax Investment Services℠, Member FINRA, SIPC, Investment advisory services offered through Avantax Advisory Services℠, Insurance services offered through an Avantax affiliated insurance agency. Not all products and services are offered by all financial professionals. Products and services listed may only be offered by properly licensed individuals.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.