SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

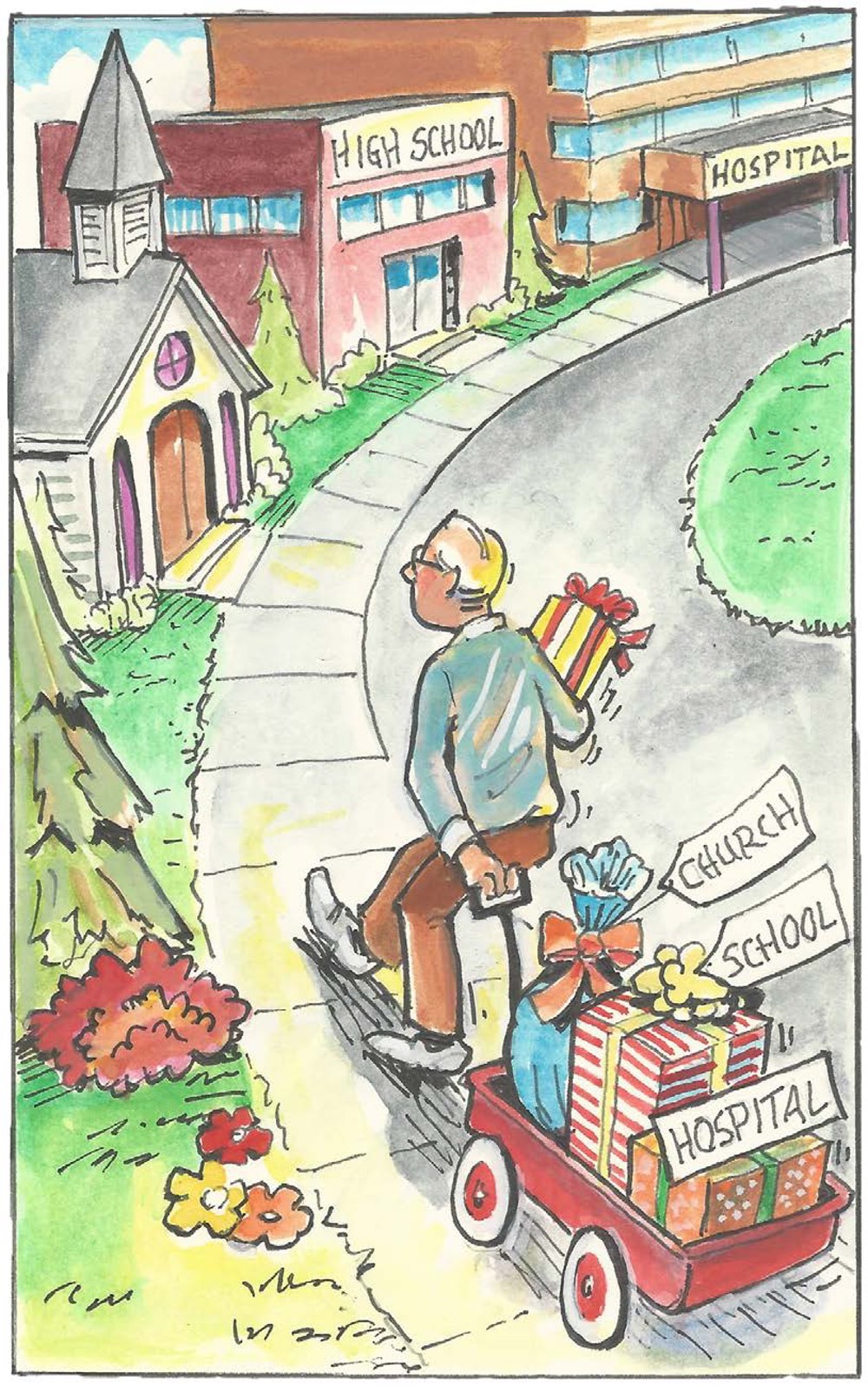

If you have considerable wealth — and even if you don’t — you might wonder how to leave a financial legacy behind for a beloved organization or favorite charity.

Giving USA found that giving by individuals grew at a higher rate than other sources of giving in 2016. Individuals gave an estimated $281.9 billion, a 3.9% increase from the prior year. With major fundraising efforts in 2017 for victims of the rash of natural disasters in North America, the pace of giving may not slow soon.

If you’re short on cash, gifts of appreciated assets like stocks can help organizations that accept them. Individuals can also name charitable organizations as beneficiaries of life insurance policies.

The CRT can specify how long an income stream will last and when the trust’s term will end, upon which assets will pass to the charitable organization named in the trust. One caveat: Make sure you are okay parting with any assets you intend to pass to a CRT, which is an irrevocable trust. Once you make the transfer, your decision is permanent.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Active Planning & Investment Solutions and LTM Marketing Solutions, LLC are unrelated companies. This newsletter was created by LTM Marketing Solutions, LLC and was not written or created by the named financial professional and does not necessarily represent the views and opinions of Cetera Wealth Services, LLC® or its subsidiaries.

Securities offered through Cetera Wealth Services LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.