SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

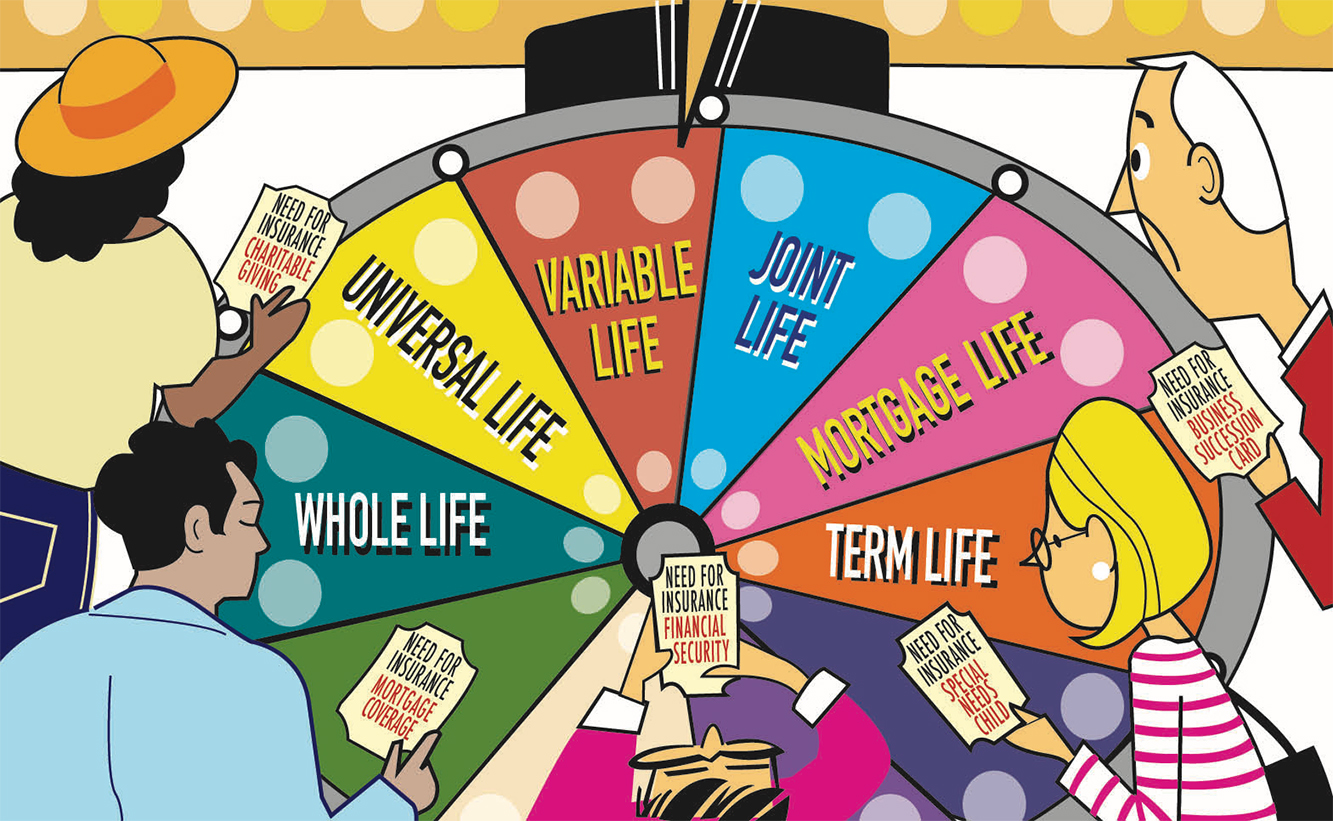

Life insurance has many uses. If a breadwinner dies, proceeds from a life insurance policy can fund a child’s college education, pay for child care or other services, and ensure that surviving members will maintain their current standard of living. It can also be part of a charitable giving strategy*.

Consult your insurance professional to see if you have any unaddressed life insurance needs - or too much coverage.

*Applications for life insurance are subject to underwriting. Insurance coverage exists only if the required premium is paid. Accessing cash values may reduce the death benefit and policy values, trigger tax consequences, surrender fees, and charges, and may require additional premium payments to maintain coverage. Guarantees are based on the claims-paying ability of the issuer.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Active Planning & Investment Solutions and LTM Marketing Solutions, LLC are unrelated companies. This newsletter was created by LTM Marketing Solutions, LLC and was not written or created by the named financial professional and does not necessarily represent the views and opinions of Cetera Wealth Services, LLC® or its subsidiaries.

Securities offered through Cetera Wealth Services LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.