SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

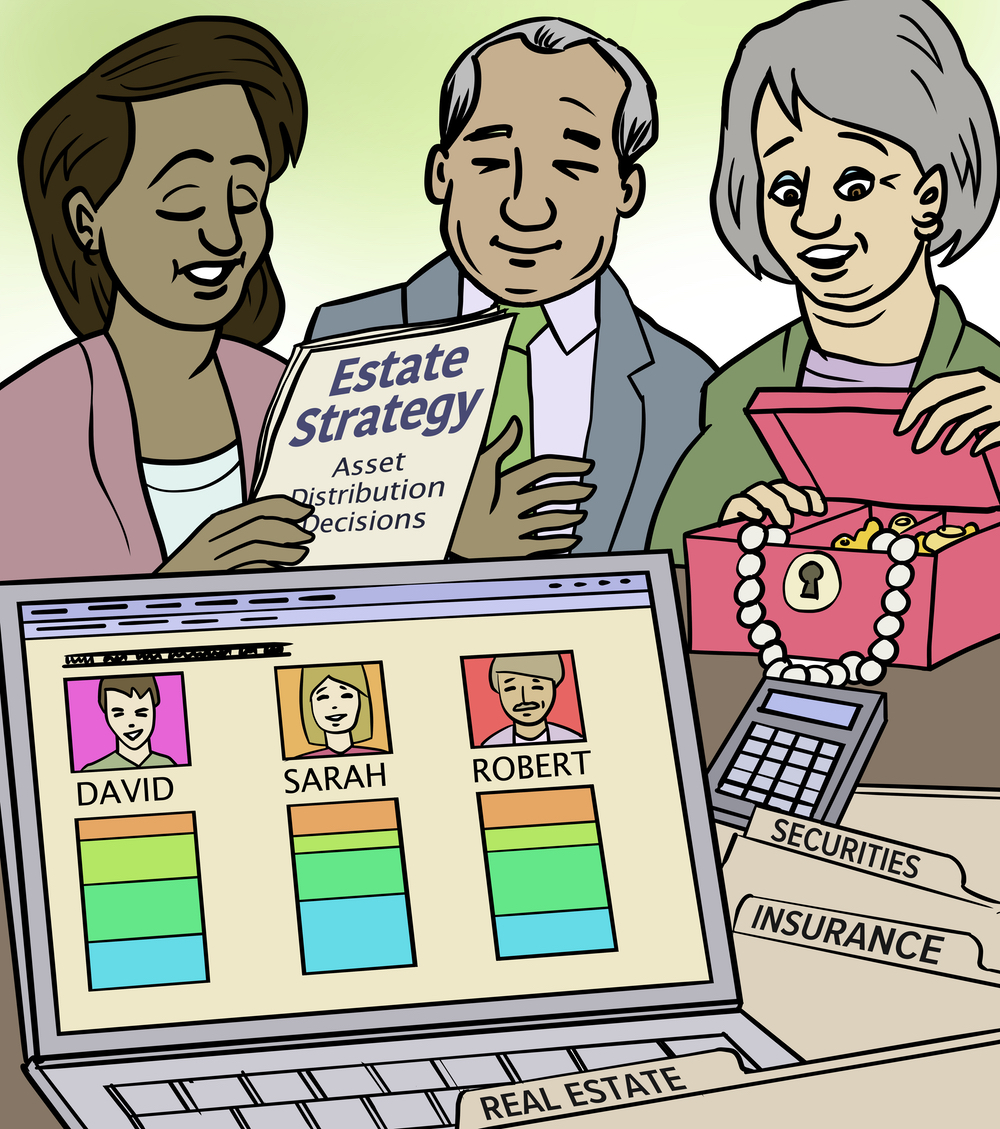

If you think of estate planning as something that is necessary for only the very wealthy, it might surprise you to learn otherwise. From keeping an updated will to having healthcare and legal powers of attorney, estate planning is so much more. And with all the paperwork involved to ensure your loved ones inherit what you intend, it’s easy to overlook something that can create an estate planning nightmare.

Whether you’re creating your first estate plan or updating an existing one — with the help of an estate planning attorney — there are some missteps you can avoid when you know what to look for. Here are a few tips:

There are two ways you might distribute the assets that can’t be split, and both begin with conversations with heirs to learn what is meaningful to whom. Once determined, you might distribute these assets while alive. Or you can add specific language to your will to ensure everyone gets their assets intact.

Talk to an attorney to learn more and to a financial professional to learn how life insurance can work in estate planning situations.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Securities offered through Cetera Wealth Services, LLC, member FINRA/SIPC. Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity. Bonanno Financial Advisors LLC and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.