SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

It’s February 1. Do you know where your New Year’s resolutions went? If your 2018 resolutions are ancient history, don’t worry—you’re not alone. Many people don’t follow through on their resolutions because they try to achieve lofty goals all at once.

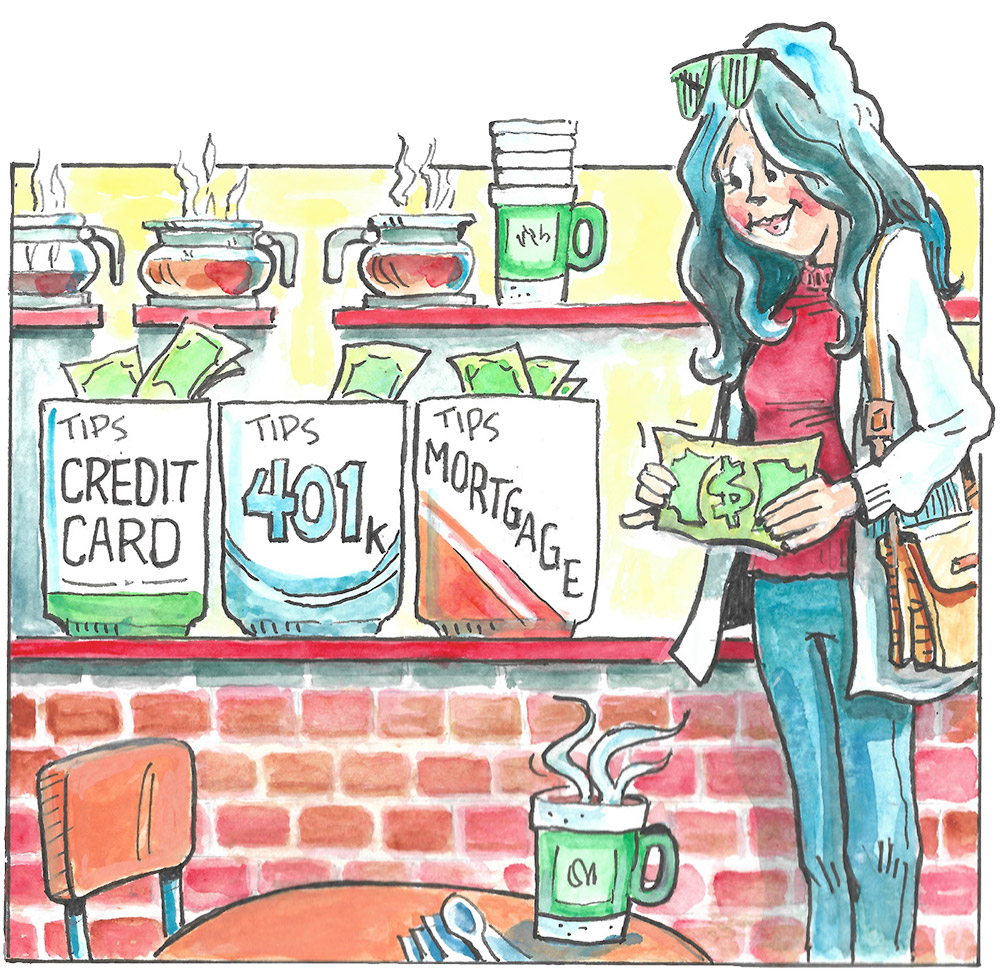

Wanting to shoot for the stars is natural, but why not take smaller, more manageable resolution bites instead? A series of small steps when approaching everything from fitness to

finance can help you eventually achieve your goals. Let’s look at some common goals and how a small-bites approach might help you.

Here’s how: Pay down extra principal each month instead of in one big annual payment. Let’s say your mortgage payment is $1,200 per month. Seems like a lot if you want to make an extra payment per year, right? Not if you pay a small bite out of your mortgage every month.

Consider putting an extra $100 per month toward your principal. After one year, you’ll have made an extra $1,200 in mortgage payments. And, if you break it down further, the extra payments cost you a little more than $3 per day.

If this sounds like too much, consider your extra contribution would only come to $10 per week. That’s barely more than the price of a designer cup of coffee. Or you can save this amount by brown-bagging your lunch once a week instead of going out.

And if you really can’t find an extra 1% to save for retirement, try starting with half of 1%.

Break it down. Make a goal of adding $100 per month to your minimum payment. This comes out to a little over $3 per day, but adds up to $1,200 over the year. Continue this without adding further debt and you’ll take years off the time it takes to pay the debt off.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Tax and Financial Solutions, Inc. and LTM Marketing Solutions, LLC are unrelated companies. This newsletter was created by LTM Marketing Solutions, LLC and was not written or created by the named financial professional and does not necessarily represent the views and opinions of Cetera Wealth Services LLC or its subsidiaries. Securities offered through Cetera Wealth Services LLC, member FINRA/SIPC. Advisory services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.